venmo tax reporting for personal use 2022

Perhaps the most notable difference between PayPal and Venmo fees for most personal users is that PayPal charges a 290 fee for personal debit card transactions while personal debit card. The IRS doesnt want you to forget its share from your wares.

New Tax Laws 2022 Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You Abc11 Raleigh Durham

In addition I was told to wait 3 weeks for a response.

. This story is part of Taxes 2022 CNETs coverage of the best tax. You can only apply for a Venmo debit card for your personal Venmo profile. Selling on the likes of Etsy and eBay.

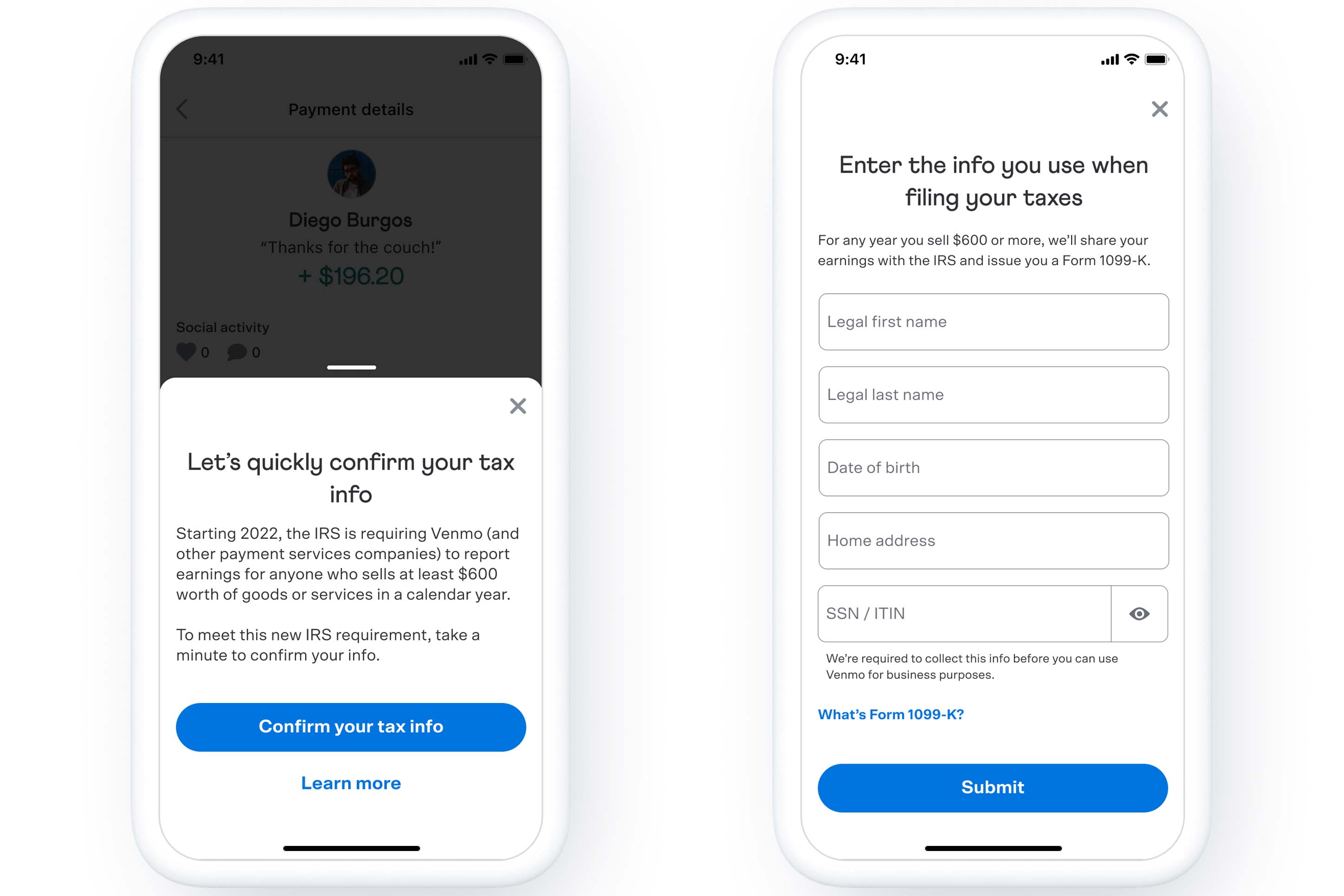

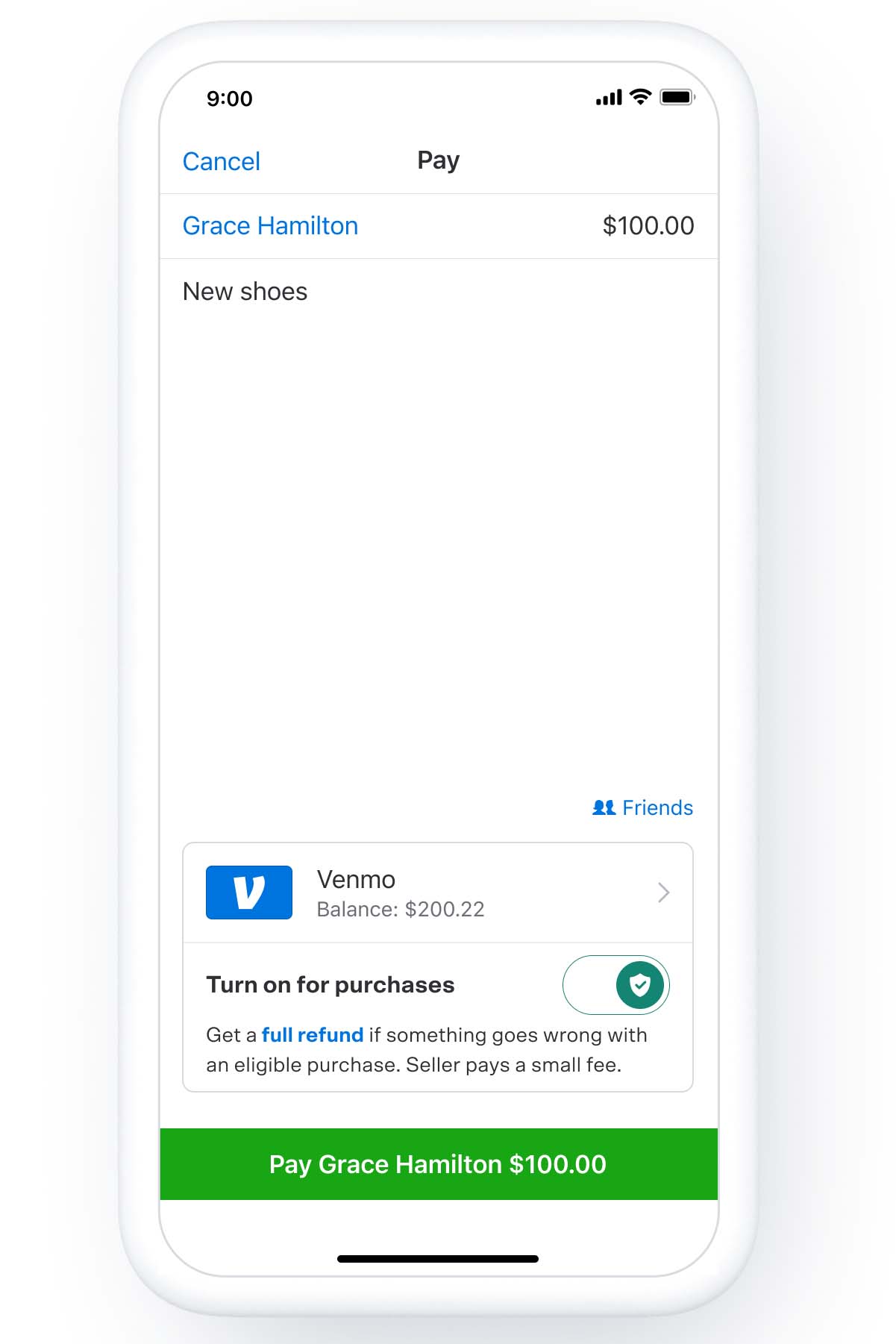

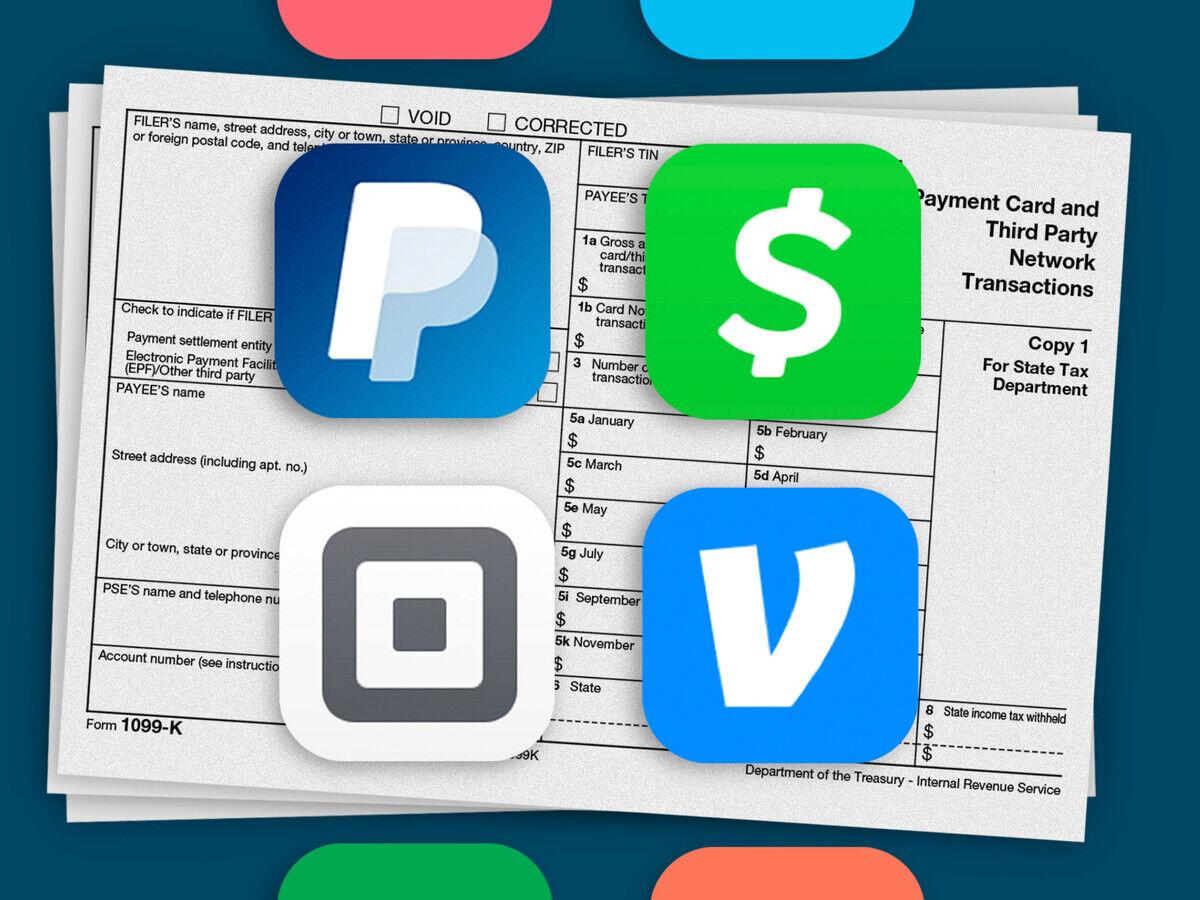

Starting with the 2022 tax year third-party payment settlement networks eg PayPal and Venmo will send you a Form 1099-K if you are paid over 600 during the year for goods or services. There are no monthly fees attached to business accounts but Venmo charges sellers 19 plus 010 per transaction through the app. July 01 2022 1755.

You should also note that the IRS will also get a. Read more about business profile fees and how taxes work on Venmo. The new rule went to effect on Jan.

The business profile fees also follow the relevant industry standards¹. So if you are waiting for a 1099-K form for the 2022 tax year which you will file in 2023 you should get the form by January 31 2023. Selling on the likes of Etsy and eBay.

Recently there have been some questions regarding changes US. The American Rescue Plan Act of 2021 modifies the IRS reporting requirement from 20000 in aggregate payments and 200 transactions to a threshold of 600 in aggregate payments with no minimum transaction number. For most states the threshold is 20000 USD in gross payment volume from sales of goods or services in a single year AND 200 payments for goods and services in the same year.

Venmo states that the personal account is for peer-to-peer payments and purchasing from authorized business profiles nothing more⁵. Venmo Business fees. Its worth noting that business profiles are subject to fees and tax reporting requirements.

As well as helping Venmo to provide other business-specific features like tax reporting enhanced payments and. The IRS doesnt want you to forget its share from your wares. Under the American Rescue Plan Act people who sell goods or services on platforms like Etsy eBay and other sites that use third-party transaction networks like PayPal Cash App and Venmo will be issued a tax form called a 1099-K for online sales totaling 600.

On August 16 2022 as the consensus of the consumers here regarding Venmo 1500 of my money is on hold due to a freeze on my account. The main reason why businesses cant use Venmo personal is that it isnt permitted. For the 2021 tax year Venmo will issue a Form 1099-K to business profile owners who have passed the IRS reporting threshold for their state of residence.

Under the American Rescue Plan changes were made to Form 1099-K reporting requirements for third-party payment networks like Venmo and Cash App that process creditdebit card payments or electronic payment transfers. The change begins with transactions starting January 2022 so it doesnt impact 2021 taxes. 1 2022 and the first 1099-K forms for people who meet the lower 600 threshold will be sent in.

Tax reporting requirements that could impact the information PayPal shares with the Internal Revenue Service IRS about transactions made using PayPal and Venmo for the sale of goods and services. Venmo business accounts are subject to tax reporting. A regular miscellaneous information reporting form which did not require much other than the payments made to independent contractors or non.

Zelle or Venmo theres a new tax reporting law. A few years ago when the gig economy was not taken seriously and employees were misclassified as independent contractors businesses found loopholes within the IRS Form 1099-MISC reporting requirements. Venmo charges fees on seller transactions so as to keep improving the service they provide as well as helping Venmo to provide other business-specific features like tax reporting enhanced payments and disputes services.

Under the American Rescue Plan Act people who sell goods or services on platforms like Etsy eBay and other sites that use third-party transaction networks like PayPal Cash App and Venmo will be issued a tax form called a 1099-K for online sales totaling 600. There Is NO 600 Tax Rule For Users Making Personal Payments On Cash App PayPal Others.

What To Know About The Irs New Reporting Requirements For Venmo Paypal And Other Payment Apps

Afraid The Irs Will Tax Your Venmo Paypal Or Other Payment App Transactions Here S What You Should Do The Washington Post

Venmo Paypal And Zelle Must Report 600 In Transactions To Irs

If You Use Venmo Paypal Or Other Payment Apps This Tax Change May Affect You In 2022

Press Release How To Confirm Your Tax Information To Accept Goods Services Payments On Venmo In 2022

Press Release How To Confirm Your Tax Information To Accept Goods Services Payments On Venmo In 2022

Changes To Cash App Reporting Threshold Paypal Venmo More

Tax Code Change Affects Mobile Payment App The Hawk Newspaper

Earning Money Through Paypal Or Venmo You May Owe The Irs Money Next Year Cnet

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/cmg/KDDFV3EA2JBJFDL3KCMEYOZ3MY.jpg)

Venmo Zelle Others Will Report Goods And Services Payments Of 600 Or More To Irs For 2022 Taxes Whio Tv 7 And Whio Radio

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor

New Venmo Paypal Tax Reporting Rules What You Need To Know Hourly Inc

The Taxman Cometh The Irs Wants In On Your Venmo

Tax Day Venmo And Paypal Users Face More Paperwork Under New Us Rules Us News The Guardian

Paypal Venmo Cash App And Most Payment Apps To Report Payments Of 600 Or More

.jpeg)

New P2p Tax Laws Of 2022 In The Us Simplified Compareremit

Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You News Wthitv Com